Centre of Excellence in Banking and Finance (CoEBF) About CoEBF

ICFAI Business School (IBS), Hyderabad

- Banking is the backbone of economy and Finance is the fuel that runs engines of the economy.

- Needless to mention the contribution made and extent of reach these sectors had on development and resilience of any economy.

- While Government and Central Bank have promoted Institutions and Centres for Research on monetary policy formulation, implementation, governance and regulation of the banking and financial sectors, various self-regulatory bodies have also shouldered the responsibilities of promoting management and operational excellence.

- There is always space for premier academic institutions to undertake unbiased enquiry that can add value to the convergence or divergence of Theory and Practices through Research, providing the much-needed feedback, thus completing the planning-implementation cycle.

About CoEBF

IFHE’s contribution towards committed scholarly professional,industry driven education is witnessed in various fields of Finance, Management, Case Research, PhD, Technology and Law. Leveraging on its experience and contributions to management education in India, the brand IBS of ICFAI group along with pioneering visionaries on the Board, the idea for Centre of Excellence in Banking and Finance (CoEBF) was conceived. Under the able guidance, constant inspiration and enthusiasm of our beloved and honourable Chancellor, Padma Vibhushan, Dr. C. Rangarajan’s, Former Governor of RBI, CoEBF came into existence in 2019.After careful examination of the various Institutions established by Government and those promoted by regulatory bodies, CoEBF of IBS, Hyderabad identified its strategic space to contribute to the field of Banking and Finance.

Vision of CoEBF

To be a noteworthy and credible Centre of Excellence (CoE), to contribute to thought leadership and be committed to the financial well-being of people and entities in India and SAARC region.

Mission of CoEBF

Augmenting practice in the Banking and Financial sectors of India, through knowledge creation, best practices dissemination, nurturing of a stream of researchers with related contemporary knowledge and skills, by bridging the gap between academia and Banking and Financial Industry, and proactive interactions with related stakeholders.

1) To undertake contemporary, relevant, and actionable research across various domains in the fields of Banking and Finance.

2) To attract and develop the best of research talent at Doctoral and Post-Doctoral levels, furthering the objectives of CoEBF, and nurturing future thought leaders.

3) To promote impactful knowledge creation through mentoring by Practicing Professionals in the sectors of Banking and Finance.

4) To provide a credible institutional structure for effective utilisation of research grants and funds, related to the sectors of Banking and Finance provided by state and non-state agencies.

5) To be an unbiased platform for facilitating sharing of best practices, for deliberating on emerging issues, and for articulating multi-stakeholder perspectives, related to sectors of Banking and Finance.

6) To explore, gather, process, curate, and disseminate knowledge related to the fields of Banking and Finance.

At CoEBF we “P O N D E R” in the fields of Banking and Finance, meaning we Provoke, Thought Leadership , Organise, Nurture, Disseminate, Empower, and Research

1) Conceiving and undertaking independent as well as collaborative Research Projects - Research

2) Organising Seminars, Conferences, Workshops, Research Colloquiums - Organising

3) Organising an Annual flagship Event (Conclave /Conference) that showcases Banking and Finance Industry - Organise

4) To contribute to Subject Matter Expertise, Resource Persons, and content to Print and Television Media relevant to sectors of Banking and Finance – Provoke Thought Leadership

5) To conduct a quarterly “FinTechLaw” event, which educates the investors about the Financial, Technological, and Legal Nuances of any chosen Financial Product - Empower

6) To promote financial inclusion and financial well-being through outreach programmes amongst the rural population and future investors, respectively - Empower

7) To nudge, mentor, and carve out few student Internships in the Banking and Finance Industry, in collaboration with the industry - Nurture

8) To eventually design and maintain a blog or website, providing a fair curated knowledge of practice in Banking and Finance – Disseminate

Prof. C Anita

Prof Anita C Raman has 26 years of experience, working with the Dept of Finance and Accounts at IBS Hyderabad. She is the Consulting Editor, Treasury Management, IUP, Brand Ambassador, Design Thinking, Institutions Innovation Council- MHRD & AICTE, and is a certified mentor, BYST – accredited by City& Guilds London.

She is a Certified Treasury Manager (CTM), MBA-JNTUH, PGDCA (Osmania University), and her Ph.D research is in the areas of Development Finance (microfinance). She is a corporate trainer, conducted several Management Develop Programs and also been a resource person and trained several senior and middle level managers from reputed organizations like Indian Railways, Singareni Collieries, ITC, Indian Army, ONGC, KILA, both in public as well as in private sectors in India. She was a part of executing and delivering MDP for Bankers in the areas of – SME banking, NPAs, stressed assets management and Finance for Non- finance Managers. She has published research articles in reputed journals and magazines. She is currently working on National research project `Penetration of Fintech applications among Marginalized Women MFI clients in India’ in collaboration with Sa-dhan (SRO- MFIs).

Dr. D.S. Chari

Prof Chary is a Ph.D. in Banking, MPhil , MBA, Bachelor of Legislative Law, Bachelor of Education and a certificated Associate of Indian Institute of Banker. Dr. Chary, a practical banker, joined IBS Hyderabad in the year 2007, and is continuing with it.

Prior to joining IBS, he was with the Syndicate Bank for 30 years. Foreign exchange and Credit Management were his areas of specialization. Dr. Chary, teaches subjects like Financial Management, Strategic Finance Management, Project Appraisal and Finance, Investment Banking and Financial Services, Wealth Management, Banking Management, Treasury Management, Legal Environment of Business, Company Law and Taxation, Commercial Law -to name just a few. Dr. Chary is a regular visiting faulty for premier institutions like C-Tara, NABARD, National Academy for construction, Federation of Co-operative banks, etc. His lectures are well received by the student community, academicians and executives of public and private sector organizations.

Prof. Koya Raghunadh

Prof Koya Raghu Nadh is an Associate Professor at IBS, Hyderabad teaching in the area of finance. Mr. Koya has a rich experience in the Indian banking industry by virtue of his association with the State Bank of India for more than 37 years.

Mr. Koya is a CAIIB and a CFA (India). He has considerable exposure to Commercial Banking, Investment Banking, Integrated Treasury Operations etc. While in the bank, he majorly worked in the area of Corporate Banking and Trade Finance (International Banking).

Mr. Koya had been a director on the board of Deccan Grameen Bank (now Telangana Grameen Bank) between 2009-2012, and the General Manager of State Bank of India operations in Dubai between 2001-2005. Before joining IBS, Mr. Koya taught International Banking and Trade Finance at TAPMI, Manipal in 2015. Mr. Koya presently teaches Financial Management, Investment Banking, Indian Financial System, Management Control and Information Systems, Management Accounting, among other subjects at IBS.

Dr. Kameshwar Rao

Dr. M.V.S. Kameshwar Rao is passionate about empowering people and contributing to organisations to make a difference, equipping himself with M. Com, MBA, CFA, ACMA, and a Ph.D. (International Finance). His three decades of professional experience began in the Banking and Insurance sectors, and later his passion for learning and development brought him into academics, in the areas related to BFSI sector. He regularly teaches in the areas of Corporate Finance, International Finance, Currency Risk Management and Analytics and his research interests lie in applicative and relevant research in the areas of Finance, Governance, and Risk Management. He has published in national and international journals. He has been engaged with the industry as a trainer and consultant for over two decades on projects related to Skill Augmentation, Business Process Improvements and Knowledge Enhancement. He has also been a resource person in several workshops organized by CII, FAPSIA, AP Chambers of Commerce, ICAI, Coffee Board of India, Tobacco Board to name a few.

Dr. Anil M

Dr. M. Anil Kumar is currently working as Assistant Professor (Finance & Accounting) at IBS Hyderabad. Earlier he was the Assistant Professor and Examinations incharge at Chaitanya Bharathi Institute of Technology (CBIT), Hyderabad. Prior to it he was Full Time Research Scholar at National Institute of Technology Karnataka, researched in the area of capital markets. He has obtained his MBA from JNTU, Hyderabad with finance as specialization and subsequently secured a number of Professional Certifications in the area of finance . He began his career at VEM Technologies Pvt. Ltd, Hyderabad as a Management trainee. Later he has started his own business as a stock broker with Angel Broking Pvt. Ltd. Thereafter he joined Reliance Mutual Fund as a Relationship Manager, after serving there about one year, he moved to teaching and has more than eight years of teaching experience. He was also a Securities and Exchange Board of India (SEBI) certified Financial Education Resource Person for conducting Financial Education Programs.

- He has received 2nd best paper award in “PhD Consortium 2015” from IIT Bombay.

- He has published in several international journals like Journal of Financial Crime, and many of his research papers are under review with reputed journals. He has presented research papers in the conferences of IIM-Ahmedabad, IIM-Calcutta, IIT-Bombay, IIT-Madras and so on.

- He has also participated in several Management Development Programs (MDP), Faculty Development Programs (FDP) and workshops in reputed institutes like Gokhale Institute of Politics & Economics, Pune, IIM-Calcutta, IIT-Madras, IIT-Hyderabad, NIT-Calicut etc.

- He has organized 19 workshops on imparting financial education in various management and engineering institutes; as a SEBI-Financial Education Resource Person, an initiative by Securities and Exchange Board of India (SEBI) and trained more than 2500 investors in India.

Dr. Munawar Sayyad

Dr. Mohammad Munawar Alam Sayyad is an Assistant Professor, Department of Finance and

Accounting and has completed his PhD (2019-2023) in management from IBS Hyderabad under the

guidance of Dr. Kaushik Bhattacharjee.

He completed his MBA (International Banking and Finance)

from Institute of Management and Technology Dubai (2015-2017) and was Gold Medalist. He has

around 2 years as Research Consultant (2017-2019) at KANTAR in Dubai. Around 3 years of experience in

Bank as Assistant Manager (2012-2015) was involved in Marketing and Credit Management of the Bank

State Bank of Travancore. Around 7 years (2005-2012) of Software industry experience includes handling

client (P&G, Barclays) requirements for FMCG, Banking and Retail industry. He has authored several

publications in journals of international and national repute. He has attended several conferences. His

teaching interests include Financial Management, Banking and Corporate Governance.

Dr. D Satish

Dr. D. Satish (Ph.D, PGDBA, M.Com, CFA (India)) is a professor and Head of the Department of Finance & Accounting at Icfai Business School, Hyderabad. His area of specialization includes sustainable Finance Corporate Finance, Treasury Management and Management of Financial Institution.

He trains Senior Bankers, Civil Servants, Senior Corporate Executives on Project Finance, Risk Management, Financial Acumen and Public Private Partnership.He has conducted more than 200 hours of corporate training. He has also written more than 250 case studies and won international case writing awards.

Prof. Kaushik Bhattacharjee

Prof Kaushik Bhattacharjee’s teaching experience spans over 14 years, cutting across undergraduate, graduate and Ph.D levels. He has a Master’s degree in Business Management and a Bachelor’s degree in Statistics. His Ph.D. is in Empirical Finance with special focus on price discovery and transmission process of American Depository Receipts.

His Ph.D. is in Empirical Finance with special focus on price discovery and transmission process of American Depository Receipts. During his Ph.D., Prof. Bhattacharjee was selected for visiting Martin J Whitman School of Management, Syracuse University in New York, USA, as a visiting Scholar. His areas of teaching include Mutual Funds, Fixed Income Securities, Derivatives and Risk Management, Banking and Analytics. Prof. Bhattacharjee has published in several national and international journals and presented papers in several conferences. His primary research interests are in areas of Empirical Finance, Banking and Mutual Funds. His research interest also lies in Empirical Finance issues using survey methodology. Before joining academics, he had worked in banking industry for about five years wherein he worked in several reputed banks in different managerial capacities. He is presently heading the CoEBF as the Chair.

Digital Transformation Colloquium (The team CoEBF heartily thank and wish the Money Market Club for their support. )

Centre of Excellence for Banking and Finance (CoEBF) in collaboration with Centre of Excellence for Digital Transformation (CEDT) organized a Digital Transformation Colloquium on Digital Transformation of Financial Services on June 21, 2024, a Panel discussion with Mr. Suryanarayana Murthy, Head of Data Science, Tide Platform Technology and Services Pvt Ltd, and Dr. Ved Puriswar’s, Angel Expert, Brane Enterprises Pvt Ltd

Fintech: Enabler or Disruptor?

Conducted a guest lecture by Mr Dilip Asbe, CEO and MD of National Payments Corporation of India (NPCI) on 5th January, 2024.

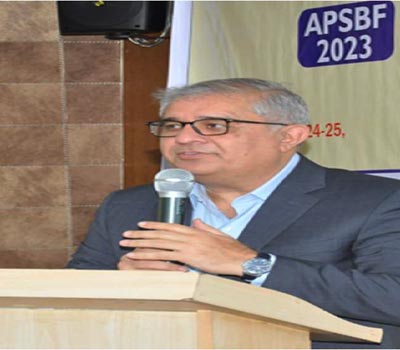

The Academicians’ & Practitioners’ on Banking & Finance (APSBF 2023)

CoEBF conducted “Academicians’ & Practitioners’ on Banking & Finance (APSBF 2023)” on 24-25 November 2023, with an objective to provide a platform for eminent industry experts from the field of Banking and Finance, and academicians to come together and exchange thoughts on issues related to ESG, Fintech, NPAs, and NBFCs.

APSBF 2023 provided an opportunity to the practitioners to present their research work and debate on the Banking and Finance issues.

The platform facilitated policy advocacy in the evolution and emerging industry growth. It is a two-day event full of insights from various industry experts and academicians.

ESG in India: Emerging Scenario

Conducted a seminar on 28th April, 2023 by Mr. Anirban Ghosh, Chief Sustainability Officer of Mahindra Group of Companies on the topic “ESG in India: Emerging Scenario”.

‘Parsimonious Modelling and Forecasting of Chronological Data’ and ‘Big Data Analytics and Algorithmic Trading Strategies.’

Conducted a day-long workshop in finance by Professor Emeritus Raja Velu, Syracuse University, on 20th February, 2023. The workshop was on ‘Parsimonious Modelling and Forecasting of Chronological Data’ and ‘Big Data Analytics and Algorithmic Trading Strategies.’

‘Current Financial Market Landscape Amidst Global Volatility and its Impact on the Insurance Sector’

Conducted a webinar on 26th November, 2022 by Mr. Ajit Banerjee, Chief Investment Officer of Shriram Insurance Company on the topic ‘Current Financial Market Landscape Amidst Global Volatility and its Impact on the Insurance Sector’.

‘Indian Microfinance-Emerging Scenarios’

Conducted a webinar on 5th August 2022 by Mr. Sudip Bandyopadhyay, Chairman of Inditrade Group of Companies, on the topic ‘Indian Microfinance-Emerging Scenarios’

1. Conclave on NPA Management

CoEBF Organised a conclave on “Non-Performing Assets (NPA) and its Resolution in Indian Banks” on 29th November 2019. There were different sessions which included paper presentations and panel discussions-for one full day.

A number of eminent bankers as well as noted academicians participated in the event. Dr Mahender Reddy, Vice Chancellor of IFHE, delivered his welcome address. Prof C Rangarajan, former RBI Governor and the present Chancellor of IFHE, inaugurated the conclave and in his inaugural speech commented on the recapitalisation issues of Indian Banks. He deliberated in detail on “How the government must recapitalise banks by infusing cash and not through issue of bonds”. The event was covered by the local press. A book of proceedings was published. The credit of successful completion of such an event goes to the CoEBF committee which was headed at that point of time by Prof B. Brahmaiah and the convenor of the conclave, Prof Y Ramakrishna.

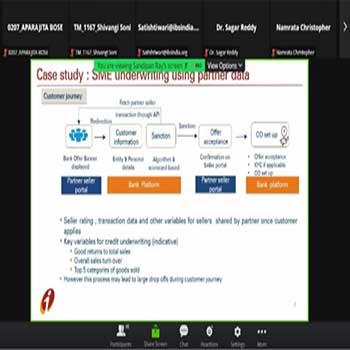

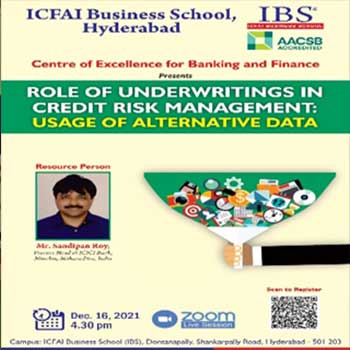

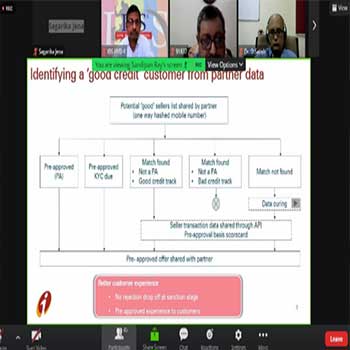

2. Webinar on Role of Underwriting in Credit Risk Management

Mr. Sandipan Roy, Practice Head at ICICI Bank, Analytics Division the main resource person of a webinar which was conducted by CoEBF on December 16, 2021.The topic of the webinar was “Role of Underwriting in Credit Risk Management: Usage of Alternative Data”. Mr. Roy analysed in detail the future of credit underwriting process with the advent of fintech even with little and incomplete information. The webinar was attended by faculty members and students of both first and second year of IBS. The webinar went on about 45 minutes followed by question-and-answer session totalling more than one hour.